Why Investors hate content risk and how to overcome it | Pocket Gamer.biz

It can be tough for video game studios to get venture capital since the market is already mature and highly competitive, there’s also no way to guarantee that the game you make will be a hit or stand out from the crowd.

So if you’re a studio that needs to raise some money what can you do? In this guest post, co-founder and general partner at venture capital firm F4 Fund, David Kaye shares four ways to overcome investor scepticism to combat content risk.

It is incredibly hard to raise venture capital for games. The biggest reason?

Content risk.

Here is how VCs like to think they make decisions:

- A founder articulates her vision of how the product she is building will create, expand or transform a market in some ideally world-changing way.

- She explains why she is the perfect person to do this, and the unique insights she has uncovered that give her an unfair advantage.

- She describes how she will take this new product to market, and gives the VC a tantalising glimpse of the trajectory the company is already on towards becoming a multi-billion dollar behemoth that will make the founder and VC outrageously rich.

- The VC carefully examines these assumptions, the founder’s experience, the product and the strategy and reaches a deeply considered independent conclusion about whether to invest.

Keeping this framework in mind, let’s unpack what VCs mean by content risk.

It is notoriously hard to judge whether any game will be a hit, especially at the earliest stages of development.

Deciding what to greenlight has traditionally been the bailiwick of gatekeepers at specialised organisations we call publishers, which are structured to fund a portfolio of bets and exploit the hell out of the few that are successful.

Even these specialists can’t do this reliably, which is why the Xbox team dismissed what turned out to be one of the biggest hits of 2023 as a “second-run Stadia PC RPG” that would be worth paying about $5M for.

Still, all this sounds a bit like what a venture capitalist does, so what’s the issue?

First, the background of your typical VC (credentialed, risk averse, business oriented) makes them much more comfortable assessing “normal” business ideas than pre-product game concepts.

Almost all VCs you talk to about your game will fall into one of two categories:

- They will have no idea what you are talking about and no way to arrive at a judgement about its merits because they lack the relevant experience.

- They will have relevant experience – they might even be former game developers – but that will make them even less confident in their ability to judge the likelihood of your game’s success from a pitch deck.

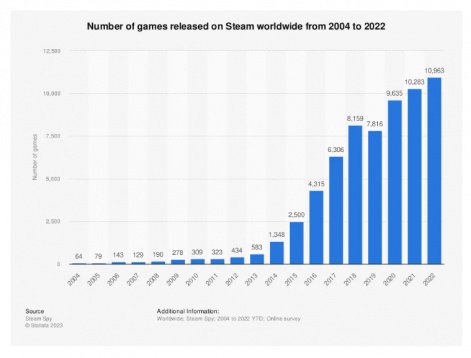

What’s more, the odds of your game being successful get worse each year as the volume of new releases keeps increasing.

Looking at these odds, giving you millions of dollars to make your game is plainly irrational.

So what do you, a game developer who needs money, do about this?

How to make us believe

Remember: VCs hate risk, and they especially hate content risk, so you have to give us other reasons to believe you will be successful. Here are a few ways to do it.

Method #1: Show proof of demand

A lot of founders are frustrated by this. How are we supposed to prove people want what we’re building without the money to create even an initial product that would get our audience excited, they ask.

Tough. You decided to start a company in the face of near-impossible odds, so it’s your job to figure this out.

There are many forms of proof, some better than others. Unfortunately, the most common one I see in developer pitches is also the least convincing: survey data, revenue of comparable titles and so forth. These are almost irrelevant, and most investors will dismiss them.

You need to show proof of demand for the specific thing you are building, not stuff that is somewhat similar.

On mobile, this often comes in the form of cohort retention and engagement data from an early version of the product launched in a test market. Multiple cohorts are better than a single cherry picked one (we see these a lot), and larger cohorts are obviously better than a golden cohort of 50 of your friends and family.

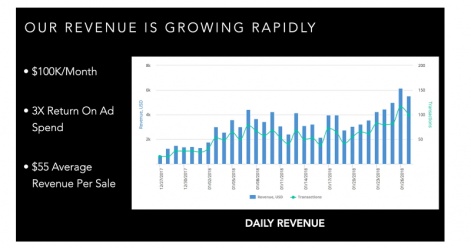

On PC, there are lots of ways to tell a ‘demand’ story. In the case of my previous startup, we set up a web store for our game and did all kinds of crazy marketing experiments to generate a consistent stream of pre-orders. This allowed us to put the following graph in our pitch deck, even though we didn’t have a product yet:

Method #2: Put a designer founder on the team

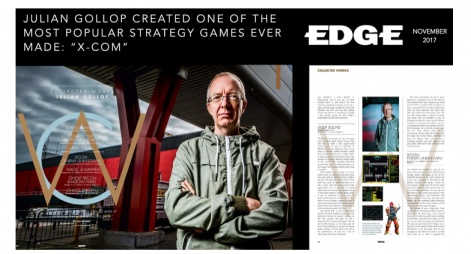

If one of your founding team was directly responsible for a highly successful game, investors will be more likely to believe they can do it again. I don’t think this is an especially good reason, and I don’t think it is sufficient on its own, but I have repeatedly seen this play an important role in deals getting done.

Method #3: Convince us you have a tailwind

VCs are mostly risk averse suits who spend a lot of time thinking about business, so talk to us in a way that positions what you are doing as taking advantage of an industry tailwind rather than another suicide mission into the jaws of the content meat grinder.

There are many ways to do this, but one of the most powerful is through the intelligent application of positioning – you have to contextualise what you are doing in a way that puts your strategy in the best possible light.

Specifically, you want to position yourself atop a wave the investor believes will transform the industry and help carry you to success (there’s always something).

Here is how we did that when we pitched Phoenix Point back in 2018:

Done properly, positioning rides the line between rhetorical sleight-of-hand and a legitimate articulation of your strategy (hopefully the latter, but let’s not split hairs).

Keep your eye on the prize: to get investors to forget about content risk and dream about the upside.

Am I embarrassed to share this when I know we only achieved 10% of the super ambitious plan we pitched? Yes. Did that plan help us to get investors excited about what we were doing? Also yes.

Method #4: Create a differentiated go to market strategy

So many game developers are incredibly creative when it comes to game design but utterly pedestrian when it comes to their go to market.

I could write an entire post on this topic, but I will leave you with a single piece of advice that will point you in the right direction: don’t just look at what other game developers are doing – steal from other industries.

In that vein, I will leave you with some exceptional advice from Wade Foster, founder of Zapier:

David Kaye is co-founder and General Partner at F4 Fund. If you are raising for a pre-seed or seed-stage games or technology company, please reach out. Getting an intro from a founder we know is best, but a well-written cold email works too.

Subscribe to the Game Stuff substack to read future essays on startups.

Edited by Paige Cook