Nvidia shows no sign of slowing down as it rakes in more than $26 billion in a single quarter thanks to data center demand

Nvidia is the darling of Wall Street as it announced its latest quarterly financial results. In short, the company is a money printing machine, beating analyst’s estimates. Its reported revenues were even higher than those from its stellar Q3 2024 earnings report.

According to its press release, Nvidia generated $26 billion in revenue over the first quarter of 2024, up 18% from the previous quarter and a massive 262% increase from a year ago. As expected, the big bucks came from its data center business and surging AI demand, which made up $22.6 billion of the overall $26 billion in revenue. That’s an increase of 23% over the previous quarter and a hard-to-believe 427% increase from a year ago.

These results saw the shares of Nvidia hit over $1,000 in after-hours trading. That means the company is clearly the world’s third largest company by market cap, well ahead of Alphabet (Google) and behind only Microsoft and Apple.

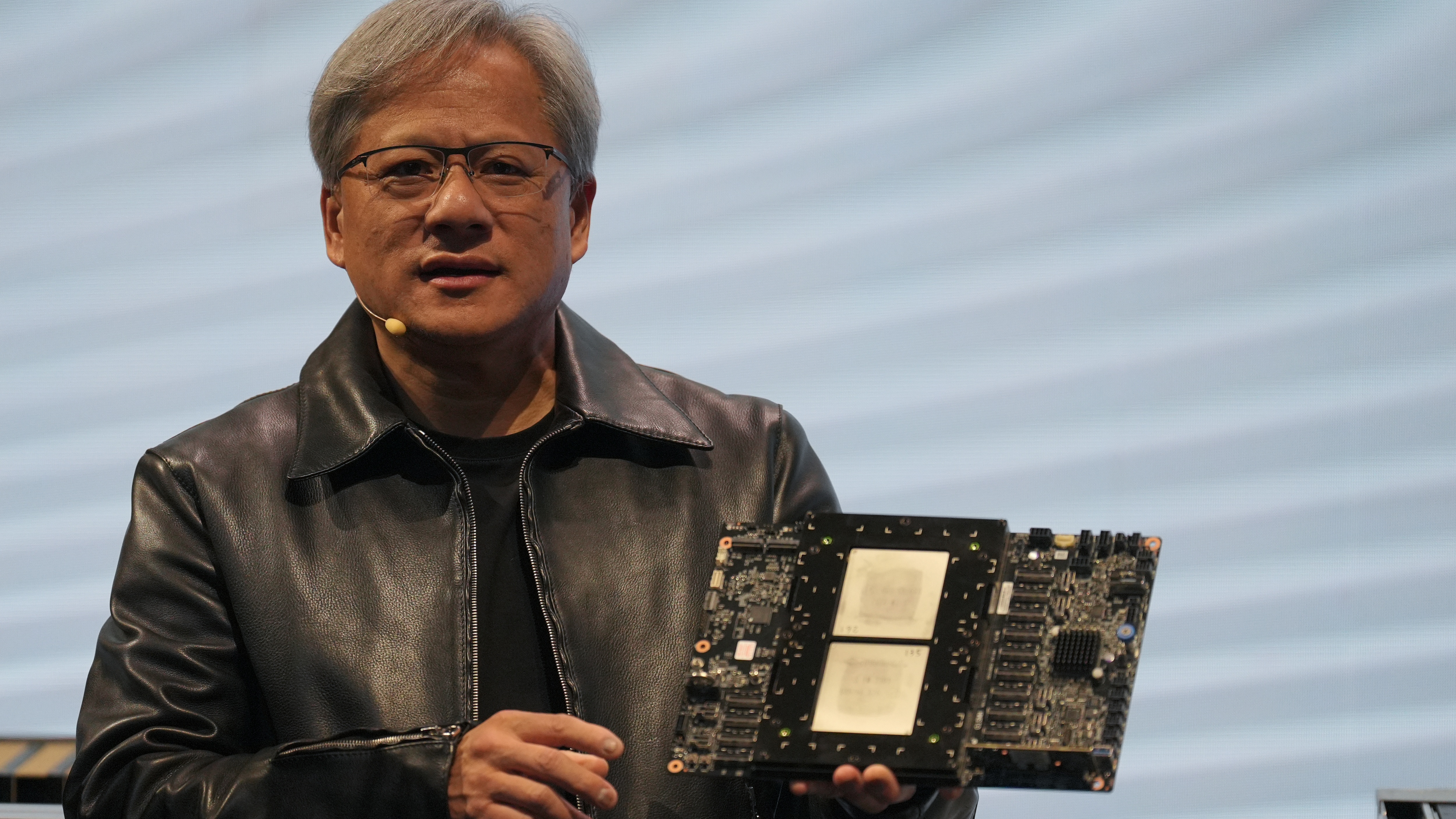

As expected, Nvidia CEO Jensen Huang is very happy with the way the business is going, and he’s bullish about what the future holds.

“The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence,” said Jensen Huang, founder and CEO of NVIDIA. “AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.”

Big words indeed.

Did you know Nvidia also makes gaming graphics cards? That side of its business was much more muted, with a revenue of $2.6 billion, down 8% from the previous quarter, but up 18% from a year ago. That quarterly fall is not really surprising following the holiday and peak trading season over late 2023 and the absence of a new GPU family. The gaming financials from upcoming quarters will be interesting as Nvidia prepares its Blackwell graphics cards.

In related news, Nvidia announced a 10-to-1 stock split, which means the value of every share will be diluted to a tenth of its original value. It doesn’t mean a lot, as it’s the same as cutting a pizza into more slices, but it will probably alter investor psychology and make whole shares easier to access.

This is definitely not financial advice, but one wouldn’t bet against Nvidia continuing its successful run in the short term at least, as long as AI demand continues unabated. It’ll be hoping its next-generation Blackwell AI chips and accompanying systems will be the catalyst for future positive earnings reports. Those Wall Street folks are fickle though, and it won’t be easy to keep beating expectations quarter after quarter.