32% of spending players in mobile games plan to cut back in 2024 | Pocket Gamer.biz

Nearly a third of in-game spenders intend to cut back this year as they aim to be more conscious of where they hand over their money, according to a new 2024 Mobile Gaming Spender Report from mobile game loyalty platform Mistplay.

The proportion of players taking a more reserved approach climbs even higher among the big spenders, of whom 41% plan to pull back in 2024.

For this reason and others, Mistplay CEO Jason Heller warned that the winners and losers of 2024 will be “disproportionate” as companies compete for limited wallets.

Incentivised spending

From a survey of around 2,000 mobile spenders in the US and Canada, Mistplay categorised players into low-value, mid-value, and high-value paying players.

Through this, findings show that 10% of high-value spenders – those with lifetime spending above $100 in mobile games – make 10 or more in-game purchases per month, while 54% make three or more purchases per month.

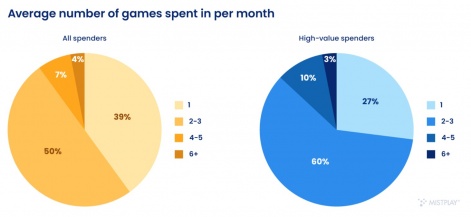

However, 39% of paying players across categories only make purchases in one game each month, mostly motivated by gameplay progression and personal satisfaction.

With paying players planning to cut back this year, Mistplay suggested optimising in-app purchase offers to encourage investment, as 33% of surveyed spenders indicated they would still spend if a deal was “too good to pass up”.

40% would also be influenced to spend more money if given personalised offers, while 51% would pay more in-game if there were extra points or monetary rewards for doing so.

Spending by genre

Looking at demographic breakdowns for genres, Mistplay’s report revealed that 81% of spenders in casual genres like match, puzzle and simulation are women. It also shows that 51% of paying players in these genres spend on two or three games monthly, while 38% spend on only one game, and the remainder make in-app purchases in more than three.

However, 28% of paying players in these genres intend to part with their money in fewer games this year, and 17% mean to spend less frequently overall.

The most prominent market in this sector is the 35 to 44 age range, comprising 37% of spenders. Those aged 18 to 24 were said to be the least likely to spend, accounting for only 3%.

This age bracket is also the least likely to spend in midcore. Across shooters, strategy games, action titles and RPGs, this age group accounts for 6% of spenders, while players aged between 35 and 44 account for 36% of paying players.

Overall, 61% of midcore paying players are men, 49% of whom spend on two or three games each month, while 40% pay money to just one game.

Similar to casual, 29% of paying players plan to spend on fewer games this year, but 26% could be convinced to spend more for items with discounts.

“In this new market maturity, there will be a disproportionate skew of winners and losers over time, as sustainable user acquisition becomes even more challenging and expensive, and the competition for a more discerning consumer wallet share intensifies,” said Heller.

“Understanding the intricacies of spender behaviour to drive LTV has therefore become essential as we all navigate this landscape.”