Deconstructor of Fun’s predictions for 2024: AI transforms the industry, DMA wil | Pocket Gamer.biz

“It will get better. Just hang in there.”

Deconstructor of Fun’s Eric Kress kicked off today’sThink Games Istanbul event by stating that, despite the current challenges, the industry will recover.

Kress said many people in mobile may not have seen a downturn before, but he stressed it has happened before in the wider games sector. “This is what happens … boom and bust,” he said.

Amid such a challenging time and lots of potential changes ahead for the games and wider tech sector, Kress, along with Deconstructor of Fun founder Michail Katkoff, offered their predictions for what 2024 could look like.

TL;DR

- Digital Market Act will make Apple bleed

- AI begins to transform ways of working

- UA recovers

- Apps overtake games in IAPs

- Investment crunch continues

- The lean times drag on

Digital Markets Act bites

This week the Digital Markets Act officially comes into force, creating a framework designed to keep large online platforms – or ‘gatekeepers’ – from abusing their dominant market positions and to create a “fairer business environment” for all companies.

Apple has made optional changes to its App Store rules in response. If publishers opt-in, Apple will reduce its revenue share to 17% – or 10% for some developers – if they use an alternative marketplace or payment option. But Apple is also introducing a core technology fee, which charges €0.50 for each first annual install per year over one million downloads for installs from the App store and/or an alternative marketplace.

Kress shared frank views on Apple’s new rules, stating they are “clearly not acceptable”.

“This is Apple at its finest right… heads you lose, tails I win,” he said.

He predicted most publishers will not opt-in to the new terms – maintaining the status quo – and that the DMA “is going to go medieval on this”.

He said it was his understanding the DMA is not to be trifled with, and believes Apple will feel the heat from regulators, forcing them back to the negotiation table.

You can see what analysts, publishers and payment providers think of Apple’s EU changes in our article here.

The lean times will carry on

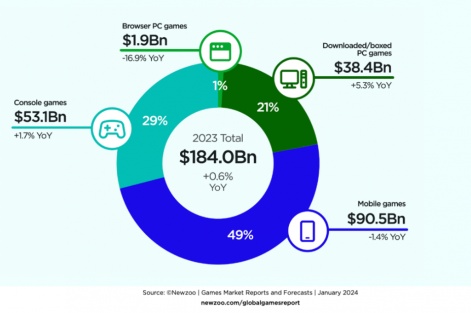

Katkoff said he expects the lean times for the industry to carry on. Newzoo data shows that the industry grew by just 0.6% year-over-year in 2023 to $184 billion, with mobile down 1.4% Y/Y to $90.5 billion.

Meanwhile, console, which Katkoff said had probably one of the best years ever for quality games, barely saw any growth at 1.7% Y/Y – a figure that doesn’t take into account inflation.

He said this was likely down to a number of factors – too many users, too many games, too many business models, while the need for hardware, pricing and a limited audience means revenue didn’t grow as expected.

Katkoff cited five key post-lockdown trends to explain the game industry’s challenges right now:

- People rekindled with outdoor activities

- Structural shifts in privacy that have shaken the sector

- Competition for media consumption has intensified (e.g. social media, streaming, podcasts, etc.)

- Geopolitical environment deteriorated revenue outlook

- Economic challenges impacted spending patterns

Lastly, Katkoff explained how inflation, which leads to high interest rates, will have an impact on games industry growth. He highlighted the oil crisis in the 1970s as evidence that, when inflation rises and interest rates do the same to combat it, rates will stay high as banks are afraid inflation will bounce back.

For games companies, the rise in interest rates right now means the cost of servicing debt has gone up, impacting in particular companies that have spent significantly on M&A for growth.

To round-up, Katkoff noted: High interest rates > Lean times for games.

- Limited consumer demand for games

- Fewer new games in development (companies avoiding riskier bets)

- Fewer investments into new projects

- Fewer exists through mergers and acquisitions

- Focus on profitability instead of growth.

- Focus on efficiency and productivity that leads to layoffs

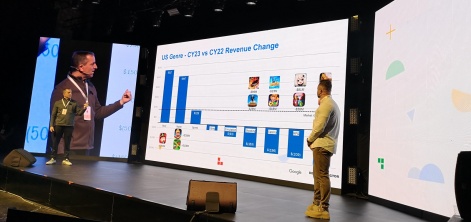

User acquisition market stabilises

After app tracking transparency led to huge challenges in user acquisition, Kress said that we’re now seeing stablisation in the UA market, which can be put down to adjustments by the likes of Facebook, Apple and Google in the ads space to adapt to privacy changes.

He noted that titles like Monopoly Go and the casual genre were growing in the U.S., though more core titles were still on the decline.

Apps will overtake games on spending

Katkoff predicted that apps will overtake games on spending.

He said that users are spending more and more time on different platforms, and questioned whether games are more sociable and addictive than apps like TikTok.

Katkoff explained that for the games industry to take the road back to growth, it needs to change from a growth market mindset to operating in a mature one. It needs to ditch the lean startup mentality for a deliberate approach, he said.

- Compelling strategy > Rapid experimentation – Developers need a compelling strategy for what they are building, and need to understand the competition, the market and their funding situation to realise it.

- Adjustments > Fail fast and pivot – Katkoff said developers need to understand what’s happening in the market and their funding situation, and know how they’ll adjust their strategy inside of that. He used the example of Scopely’s Monopoly Go, which took seven years to make and went through adjustments.

- Don’t overfocus on testing – While testing is important as you progress through the development cycle, there shouldn’t be too much focus on this.

- If you build if, they won’t just come – Katkoff said publishers need to think about growth from the start of a game, not just when the KPIs are good.

The state of M&A

Discussing the state of the M&A space, Kress said he did not expect any mega mergers in the near future.

He noted one of the fundamental problems for M&A is the lack of acquirers right now. Zynga is off the board, EA is licking its wounds from the Glu deal, and Scopely is taking a break. Meanwhile, the likes of Embracer and Stillfront “have collapsed”. Kress said there may be smaller M&A deals, however.

When it comes to the VC market: “it’s going to be a slog”, said Kress, stating that investors may chase the rainbow of AI or even invest in crypto again.

As for public markets, Kress said a lot of big players have been taken off the board – like Activision and Zynga – but he expects Epic to go for an IPO in the next 18 to 24 months. Overall, the public markets will be “pretty active” over the next few years, he said.

AI transforming the industry

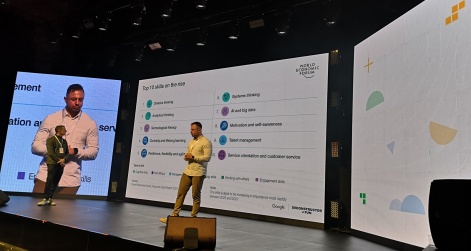

Concluding the talk, Katkoff delved into the ways AI is transforming the way developers make games.

- Compact teams’ creativity is not held back by a lack of resources – With extra tools, small teams can potentially now make bigger games or start operating them as a service

- Large teams will create immersive worlds

- Experienced professionals who embrace AI can become invaluable

- Less experienced professionals could become replaceable.

He highlighted top skills people in the industry can work on to adapt to this trend (also outlined by the World Economic Forum), which included: creativity, analytical thinking, technological literacy, lifelong learning and resilience.