Hypercasual’s not dead… But it is slowing down | Pocket Gamer.biz

Over the past few months question marks have begun to appear regarding hypercasual’s longevity. Now, via a report from LiftOff the evidence appears to show that the genre is certainly in decline.

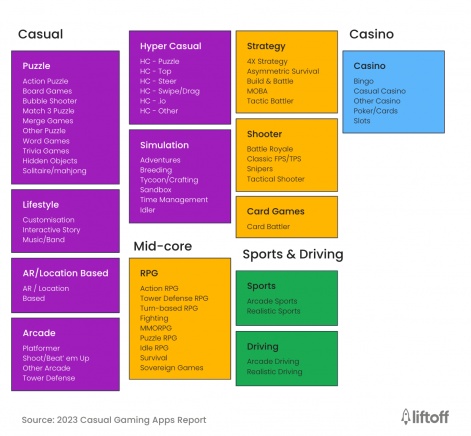

According to the new report the hypercasual market has seen a 20% decline in install share. From 50% in Q1 2021 to 30% in Q1 2023. This is partially attributed to IDFA, which impacted the ad monetization models used by many of these games. As with many others however, LiftOff predicts that hybridcasual will be the way of the future and points to Voodoo’s Mob Control with its mix of IAA (in-app ads) and IAPs as an idea of how this genre will find success.

The walking hypercasual dead

Hypercasual’s fall from grace is not quite as dramatic as it may sound. The simple fact is that the ad-based monetization was bound to take a knock when IDFA kicked in. Hybridcasual manages to avert this by including more serious monetisation options, such as in-app purchases. Not only that but the design and therefore development skills and lessons learned from hypercasual can easily be brought over to a hybridcasual title with only minimal changes to facilitate a longer life-cycle.

As LiftOff points out with Mob Control, Voodoo has been slowly scaling their monetisation. Including raising the bar by adding gacha mechanics and even battle-pass seasons, all of which would seem completely at odds with the accepted notions of hypercasual game design. The increasing diversity of the genre reflects the actual mix of sub-genres which drive mobile gaming.

Competing priorities

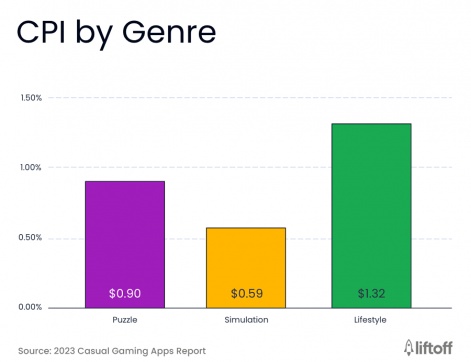

Other insights include CPI remaining low for Android at only $0.63, but iOS being nearly triple that at $2.23. Competitive events also seem to be big winners, as the top ten highest grossing casual games all featured some form of competitive play.

LiftOff provides the example of Royal Match for the success of competitive elements, where key player motivations that ranked highly were “thinking & solving” and “completing milestones.” However, it also scored much higher than average on the “competing against others” category for its genre.

Mini-game madness

One interesting section notes that minigames are abundant, with 20% of the top 200 grossing games including them. Of course not all of these are minigames as we might expect in major titles, with some being temporary and some even being added to comply with advertising standards.

LiftOff identifies four core approaches. UA creatives which are “slapped on” and usually are put in to comply with advertising, UA creative as a mode which adds them in as permanent, minigame-events with temporary minigames and finally permanent minigames designed to vary core gameplay.

Is match3 oversaturated?

Match3 is notable for having one overall dominating presence, which is the undying eldritch monolith that is Candy Crush Saga. It was the title that arguably sparked the entire match3 craze to begin with, and it remains one of the most popular mobile games and most popular match3 titles to this day.

LiftOff notes only two traditional match3 games, BTS Island (themed after the megapopular Kpop boyband) and Garden Affairs have managed to be succesful in the last two years. Merge games, according to them, are the genre to watch in terms of emerging trends. With match3 facing stagnation it may just be that this genre finds a new Candy Crush, whether from existing titles or a new release. As always, adaptation is key.

As noted by head of analytics at GameRefinery (a LiftOff company) Joel Hulkunen: “If mobile game developers are to succeed in this competitive landscape, it’s important to tap into revenue-driving trends that are proving to be a hit with casual gamers. By adopting the latest trends, such as hybrid elements and competitive events, casual game developers can continue to boost engagement and retention while providing enticing opportunities for advertisers.”

Overall, while the mobile market is in a healthy place, things are definitely changing. While IDFA has succeeded in handing Apple more control of its ecosystem, continued high CPI costs will likely squeeze developers and publishers. However, the challenges presented and innovation necessary to deal with the hypercasual recession will likely lead to more lessons learned across the entirety of mobile, not just the emergence of the new hybridcasual genre.